The question of the cost of living in the United States is intimately connected to the issue of the so-called “wage stagnation,” which is typically blamed on economic liberalization that started under President Carter, gathered steam under President Reagan, and peaked under President Clinton.

According to a 2015 report issued by the Economic Policy Institute, a pro-labor think tank based in Washington, D.C., “ever since 1979, the vast majority of American workers have seen their hourly wages stagnate or decline. This is despite real GDP growth of 149 percent and net productivity growth of 64 percent over this period. In short, the potential has existed for ample, broad-based wage growth over the last three-and-a-half decades, but these economic gains have largely bypassed the vast majority.”

True, adjusted for inflation, average hourly earnings of production and nonsupervisory employees in the private sector (closest approximation for the quintessential blue-collar worker that I could find) have barely changed between 1979 and 2015. In October 1979, average hourly earnings stood at $6.51 or $21.20 in 2015 dollars. In October 2015, average hourly earnings stood at $21.18 – slightly below the inflation adjusted 1979 level.

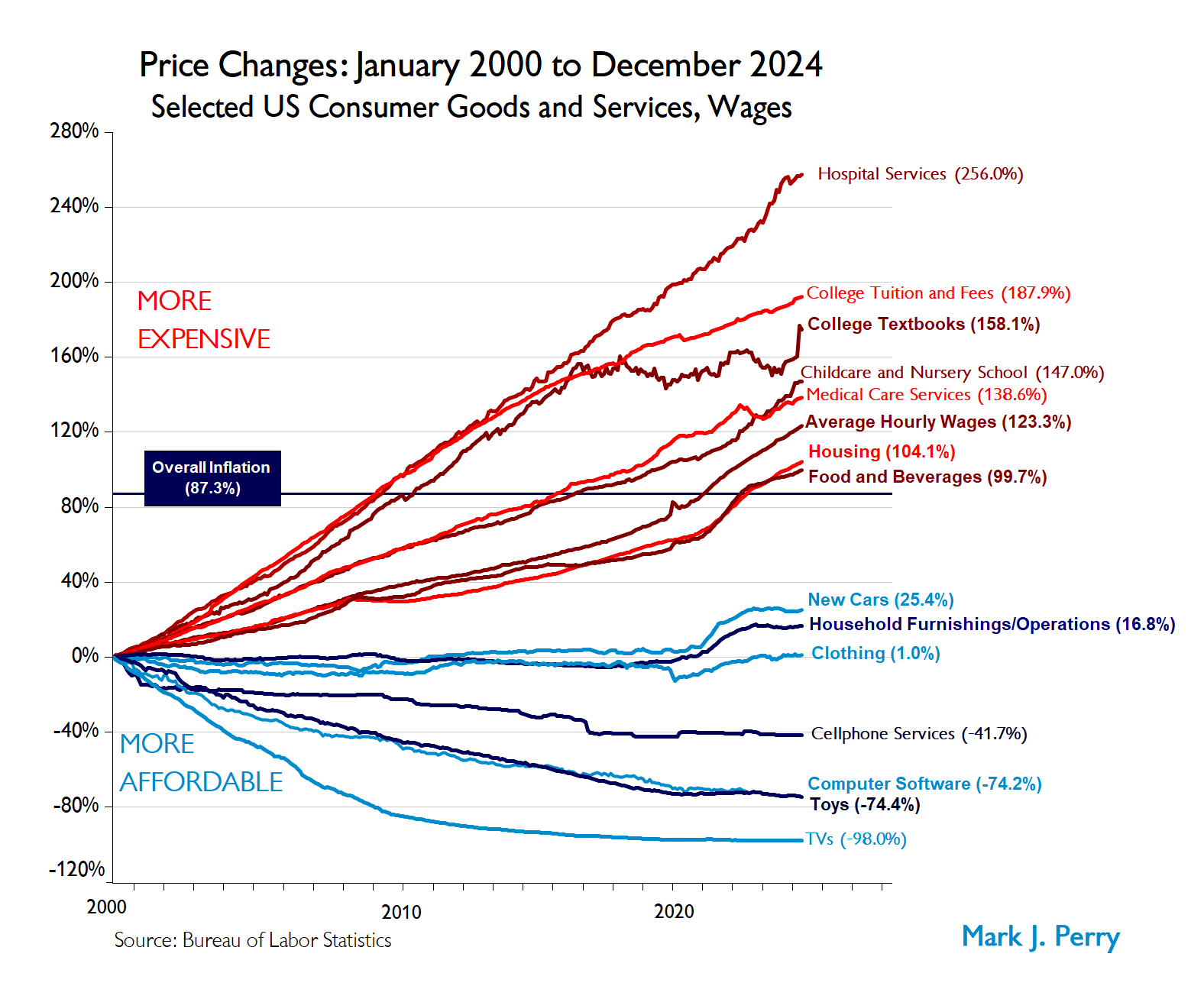

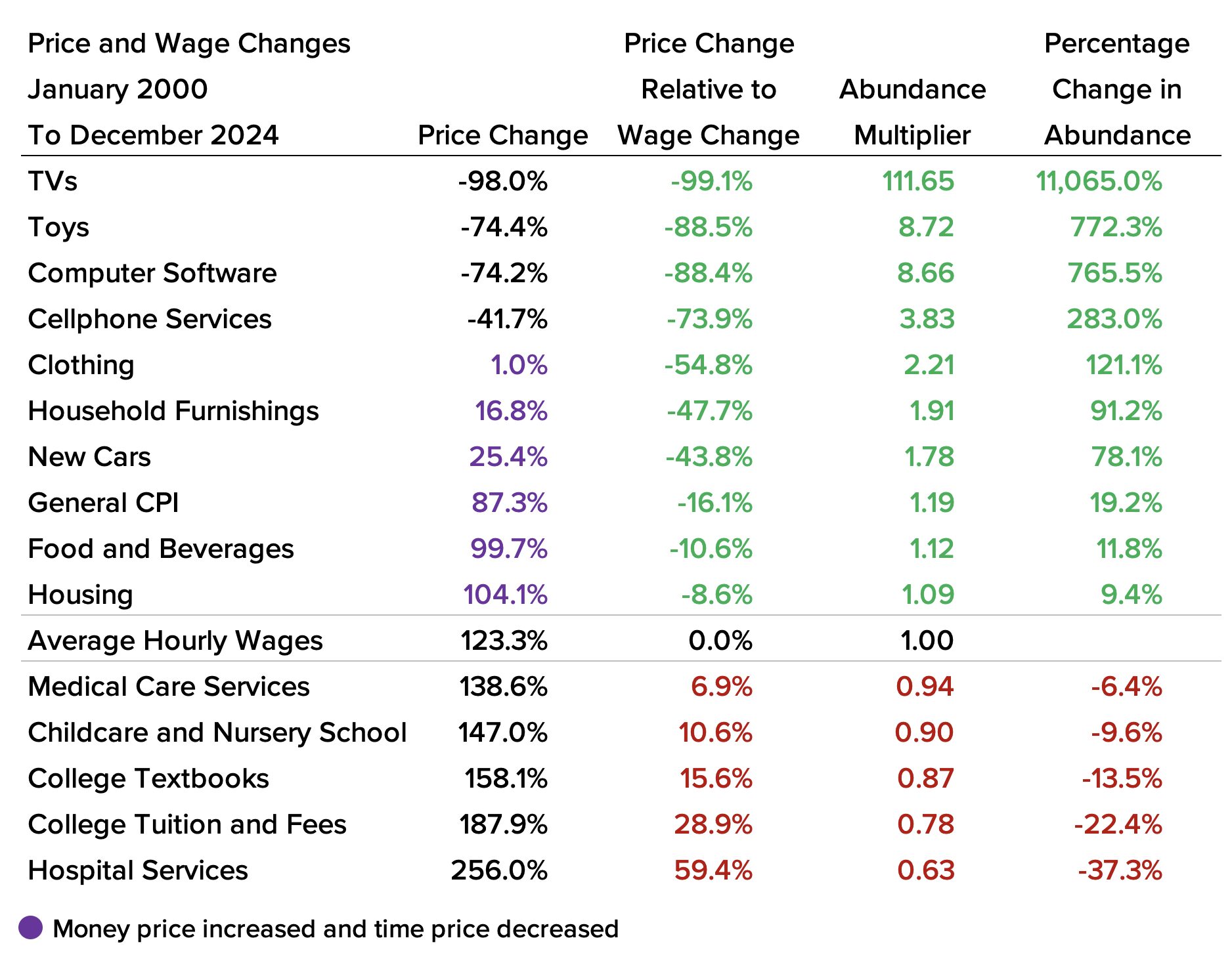

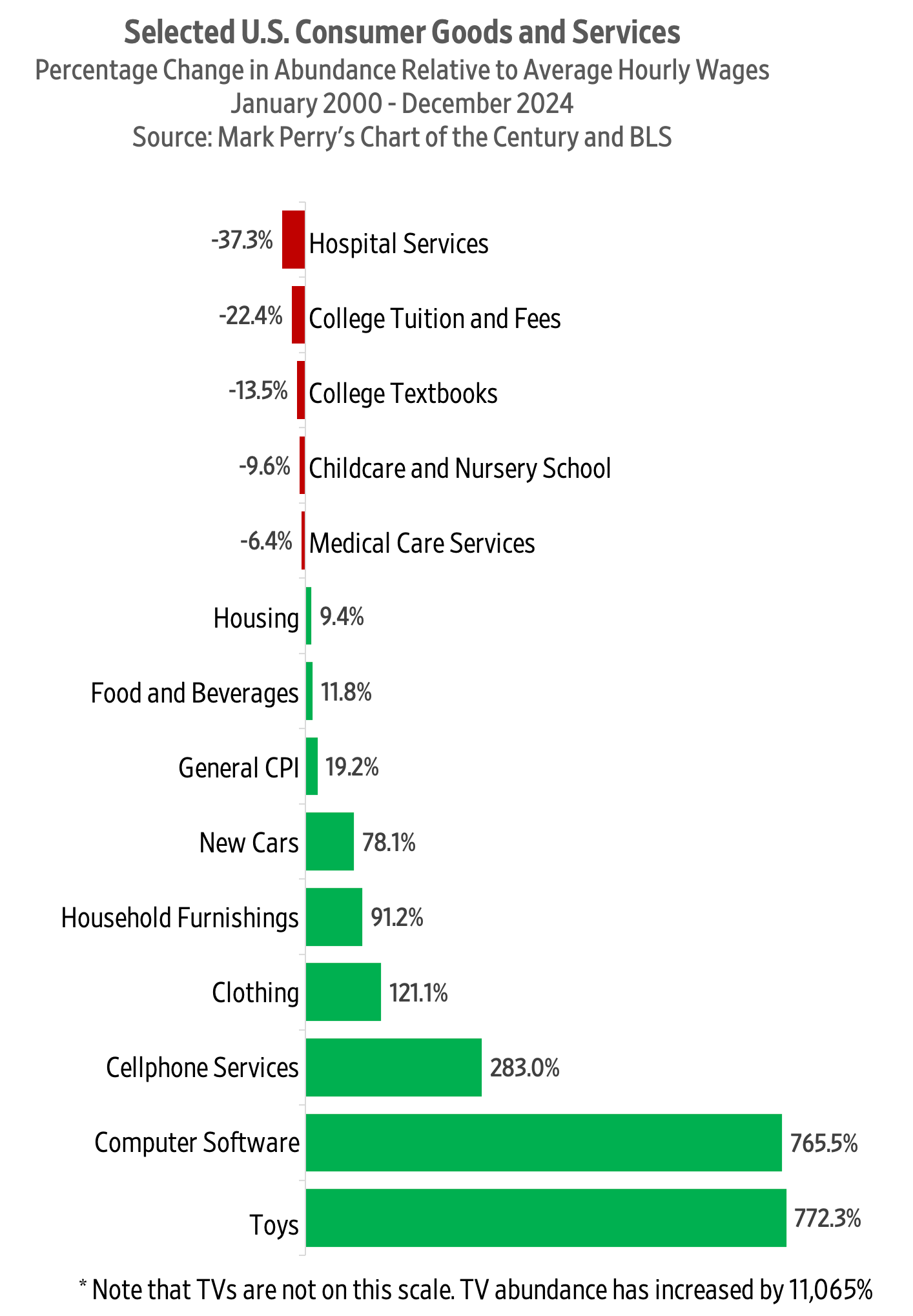

Looking at the average hourly earnings, however, ignores at least three very important factors: expansion of non-wage benefits, fall in the price of consumer goods and rise in price of services, such as education and healthcare.

First, in recent decades, non-wage benefits expanded. Today they include relocation assistance, medical and prescription coverage, vision and dental coverage, health and dependent care flexible spending accounts, retirement benefit plans, group-term life and long term care insurance plans, legal and adoption assistance plans, child care and transportation benefits, vacation and sick paid time-off, and employee discount programs from a variety of vendors, etc.

It is not easy to put an exact figure on the value of those non-wage benefits, but they could amount to as much as 30 or even 40 percent of the workers’ earnings. The lion’s share of the non-wage benefits, as my Cato colleague Peter Van Doren wrote in 2011, is consumed by “the dramatic increase in health insurance costs.” “The fixed costs of health insurance,” Van Doren shows, “are a much larger percentage of the total compensation of lower-earnings workers.”

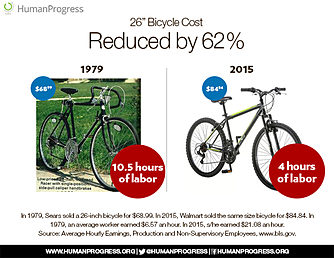

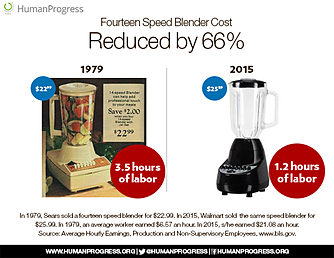

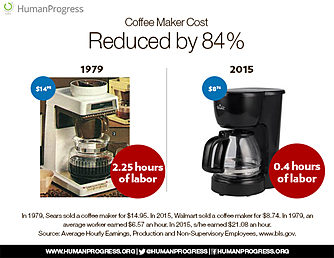

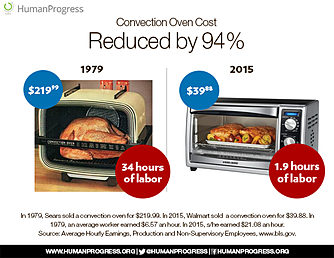

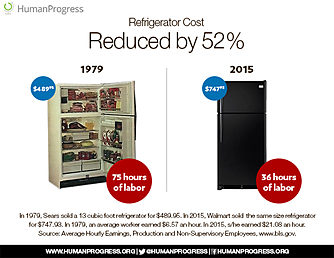

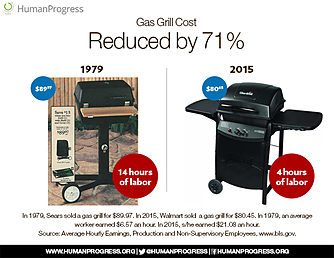

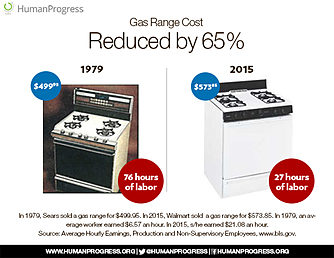

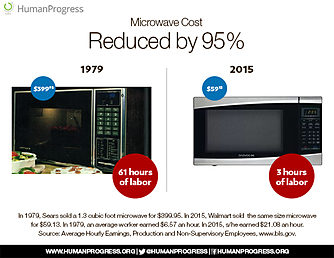

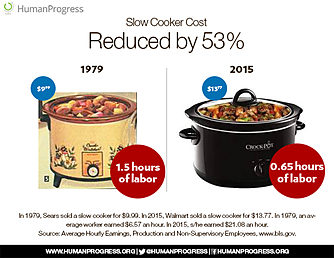

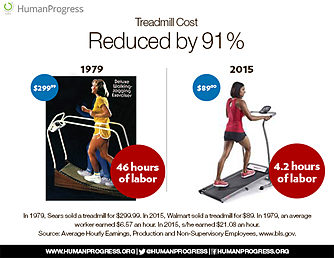

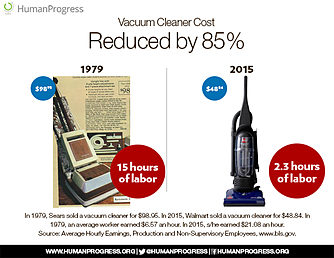

Second, many, perhaps most, big-ticket items used by a typical American family on a daily basis have decreased in price. Over at Human Progress, we have been comparing the prices of common household items as advertised in the 1979 Sears catalog and prices of common household items as sold by Walmart in 2015.

We have divided the 1979 nominal prices by 1979 average nominal hourly wages and 2015 nominal prices by 2015 average nominal hourly wages, to calculate the “time cost” of common household items in each year (i.e., the number of hours the average American would have to work to earn enough money to purchase various household items at the nominal prices). Thus, the “time cost” of a 13 Cu. Ft. refrigerator fell by 52 percent in terms of the hours of work required at the average hourly nominal wage, etc.

Needless to say, the above price reductions greatly underestimate the totality of welfare gains by an average American, by ignoring qualitative, aesthetic and environmental improvements on commonly used items. (To give just one example, a refrigerator today uses one-third of the electricity used by a refrigerator in the 1970s.)

From the above discussion it might be reasonable to conclude that Americans are much better off today than they were in the late 1970s, but that would be too simplistic. The cost of education, healthcare and housing has risen at a faster pace than total compensation. It is true that today’s houses are larger, healthcare better, and education more high-tech than in the past, but quality improvements do not seem to account for the entirety of price increases. For example, there appears to be a high degree of academic consensus that housing price inflation is driven, primarily, by zoning laws. (No such consensus, alas, exists for the rise in education and healthcare costs.)

The question of standard of living is a complex one. The accompanying infographic refers to merely one part of the debate, i.e., affordability of commonly used items. While we believe that the infographic tells an important story, it should be considered within a broader context, including non-wage compensation and offsetting increases in the cost of housing, education, and healthcare.

This first appeared in Reason