The high price of eggs may have incentivized a burglar to heist 100,000 eggs from the back of a trailer in Pennsylvania. Have eggs ever been more expensive? The surprising answer is yes—much more. In 1919, eggs were five to six times more expensive: A dozen eggs were 61 cents, or around 5 cents per egg. Wages for unskilled workers at the time were around 25 cents per hour, so these workers had to spend around 12 minutes to earn the money to buy one egg.

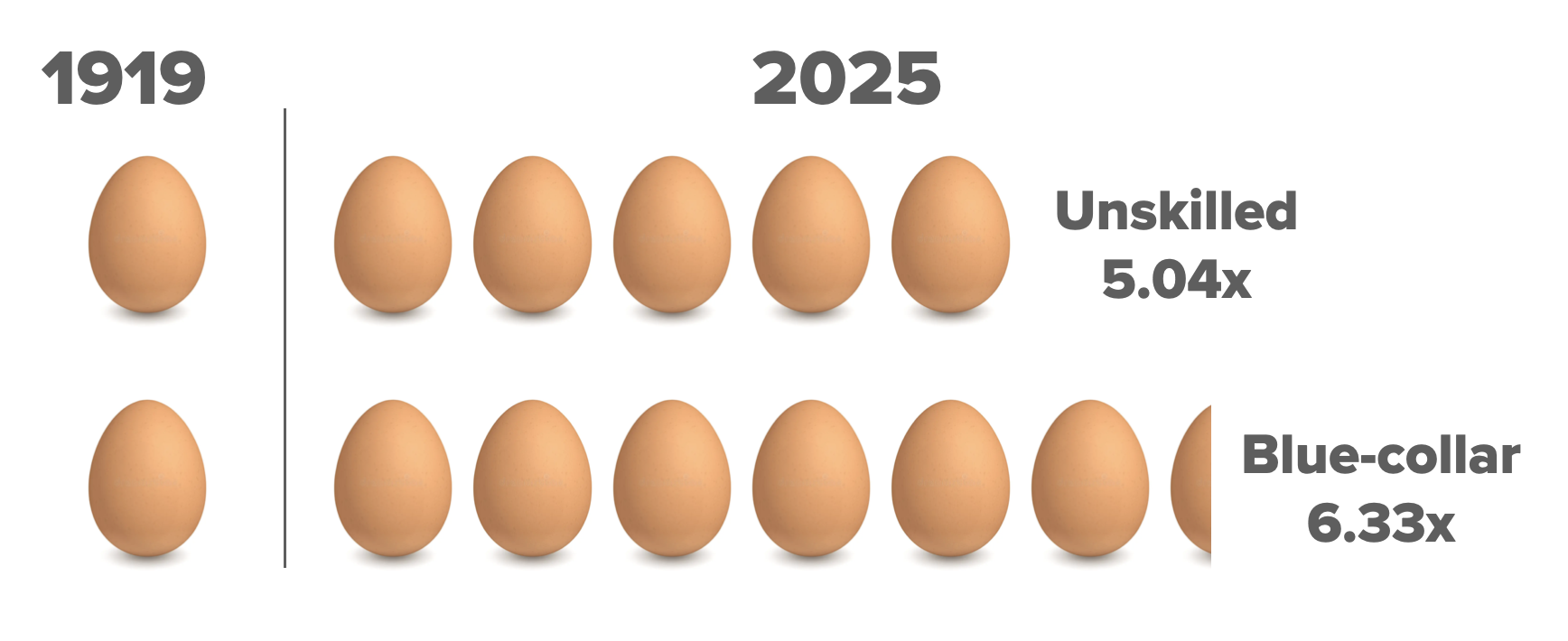

Eggs at Walmart at the time of writing (Feb 14) are $8.32 per dozen, but unskilled worker wages and benefits have increased to $17.17 an hour. That would put the time price for one egg at 2.4 minutes. The time price for unskilled workers has decreased by 80 percent since 1919. For the time required to earn the money to buy one egg in 1919, unskilled workers get five today. They’re 400 percent better off.

How about blue-collar workers? Wages for blue-collar workers in 1919 were around 43 cents per hour, so an egg cost them 7 minutes. They’re now earning $37.15 an hour, so their time price for one egg is 1.1 minute. The time price for skilled workers has decreased by 84 percent since 1919. They get 6.33 eggs today for the time it took to buy one egg in 1919. They’re 533 percent better off.

Yes, the money price of an egg today compared to 1919 is high, but the time price is much lower. Always compare the money price to hourly wages to see the time price, since that is the true price we pay for things.

Why did the price jump so high? The USDA recently ordered the culling of millions of chickens in response to worries about bird flu. Reduce supply like that and prices are bound to increase.

Fortunately for us, chickens lay lots of eggs, so the market should be resupplied soon. I have such great faith in our egg-laying friends and free-market entrepreneurs that I’m willing to bet $1 that the time price of eggs will be lower in February 2026 than today. Any takers?

Find more of Gale’s work at his Substack, Gale Winds.