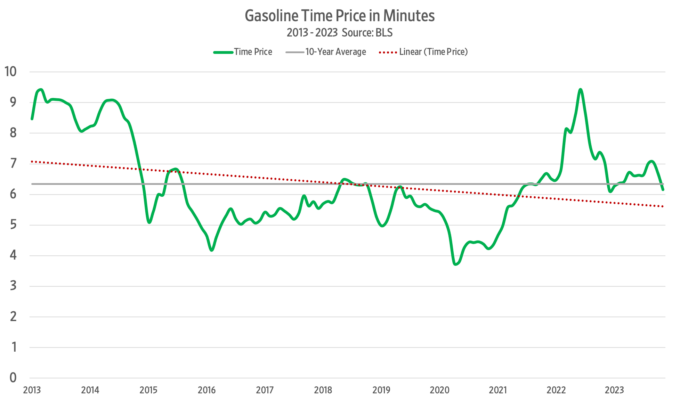

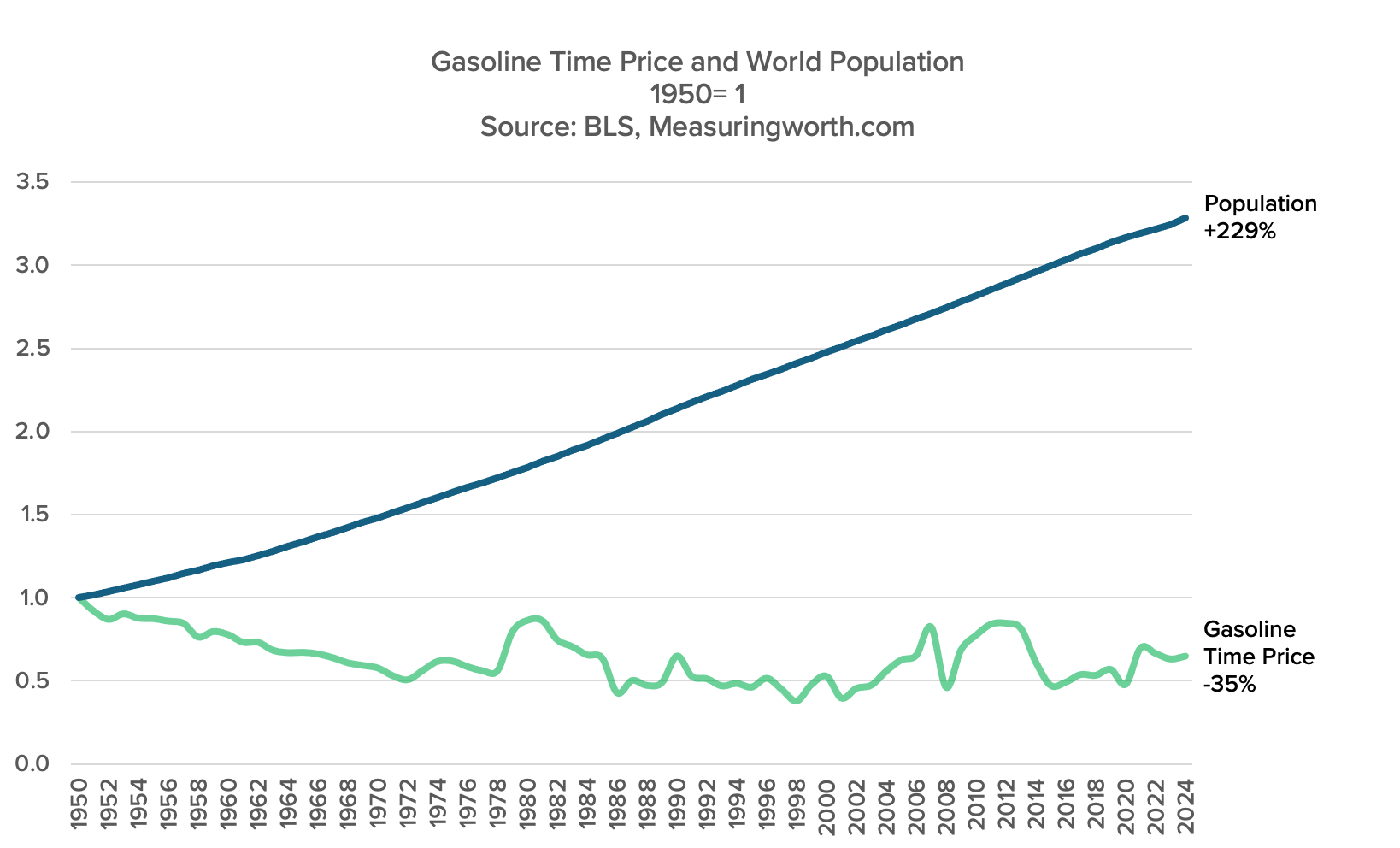

Summary: Since 1950, the global population has grown by 229%, yet the time price of gasoline for US blue-collar workers has fallen by 35 percent, illustrating an enormous increase in personal gasoline abundance. By fostering free markets and entrepreneurial energy, societies like the United States have shown how the power of knowledge and innovation can transform finite physical resources into increasingly abundant commodities.

Since 1950, the time price of gasoline for US blue-collar workers has fallen by 35 percent. For the time it took to earn enough money to buy a gallon of gasoline in 1950, today’s blue-collar workers can buy 1.54 gallons. That means personal gasoline abundance has increased by 54 percent.

Crude oil is refined to make gasoline, and the market for crude oil is global. Since 1950, the world population increased by 229 percent, from 2.5 billion to almost 8.2 billion. How is that possible, since, according to Thomas Robert Malthus and Thanos, the opposite should occur? It’s because Malthus and Thanos mistakenly assumed that only atoms could be resources and that since we have a finite number of atoms, we must also have a finite number of resources.

The truth is that atoms without knowledge are not, in fact, resources; they have no intrinsic economic value. It’s only when we add knowledge to atoms that they become resources. Since there’s no limit to the amount of knowledge yet to be discovered, created, and shared, resources can be infinite.

The gasoline-population chart shows that more people mean more abundant gasoline, proving Malthus and Thanos wrong in their assumptions.

In the 1970s, people obsessed over the number of barrels of oil in proven reserves. They thought we had discovered all the oil. By dividing the quantity in proven reserves by the annual consumption, they calculated the date we would run out. That flawed approach of Malthus and Thanos fails to recognize that it’s the price of a resource, not its quantity, that matters. Humans react to increasing prices in a variety of ways; they consume less, search for more, look for substitutes, recycle, etc. These actions ultimately reduce prices and increase abundance. What increasing prices really does is focus our energy on discovering new knowledge, which transforms scarcity into abundance.

When prices go up, we not only look for more oil, but we also innovate ways to use it more efficiently. The top-selling car in 1980 was the Oldsmobile Cutlass. Gas mileage on this vehicle averaged 20 miles per gallon (17 city/23 highway). By 2023, the Honda CR-V was the most popular two-wheel drive car. The CR-V reported mileage at 31 miles per gallon (28 city/34 highway). This improvement in mileage represents an increase of 55 percent over this 43-year period (1980–2023). Mileage has been increasing at a compound rate of around 1 percent a year. Today’s cars are also much safer and more reliable, durable, and comfortable.

The lesson of gasoline over the past 74 years is that as the price increases, we find more of it, and we find more productive ways of using it. Then the price goes down. That has been true for all kinds of products, not just gasoline.

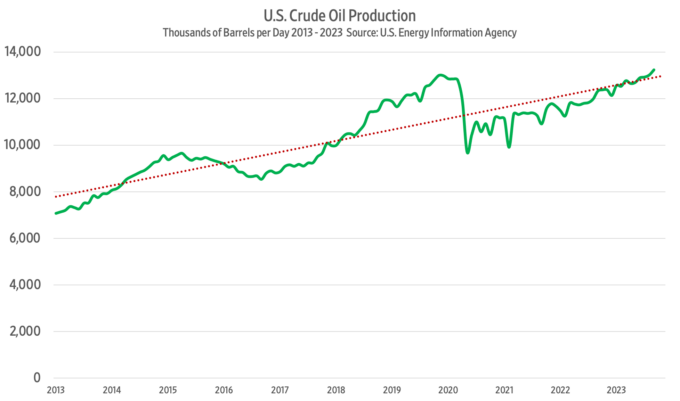

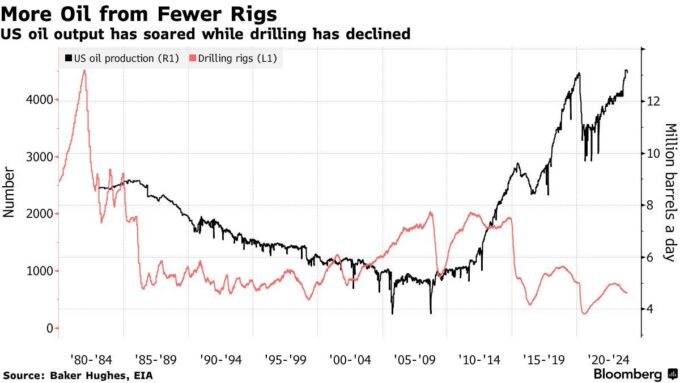

The exceptions are those manipulated by the government on the supply and/or demand side. President Richard Nixon imposed price controls in the early 1970s that were not fully removed until President Ronald Reagan did so in the early 1980s, allowing the free market to work its magic. Then fracking and horizontal drilling were applied to oil exploration, thanks in part to Harold Hamm’s Continental Resources in Oklahoma City. That company was a major player in the development of the Bakken formation in North Dakota, which led directly to massively increased domestic production and eventually resulted in the United States becoming a net exporter of oil.

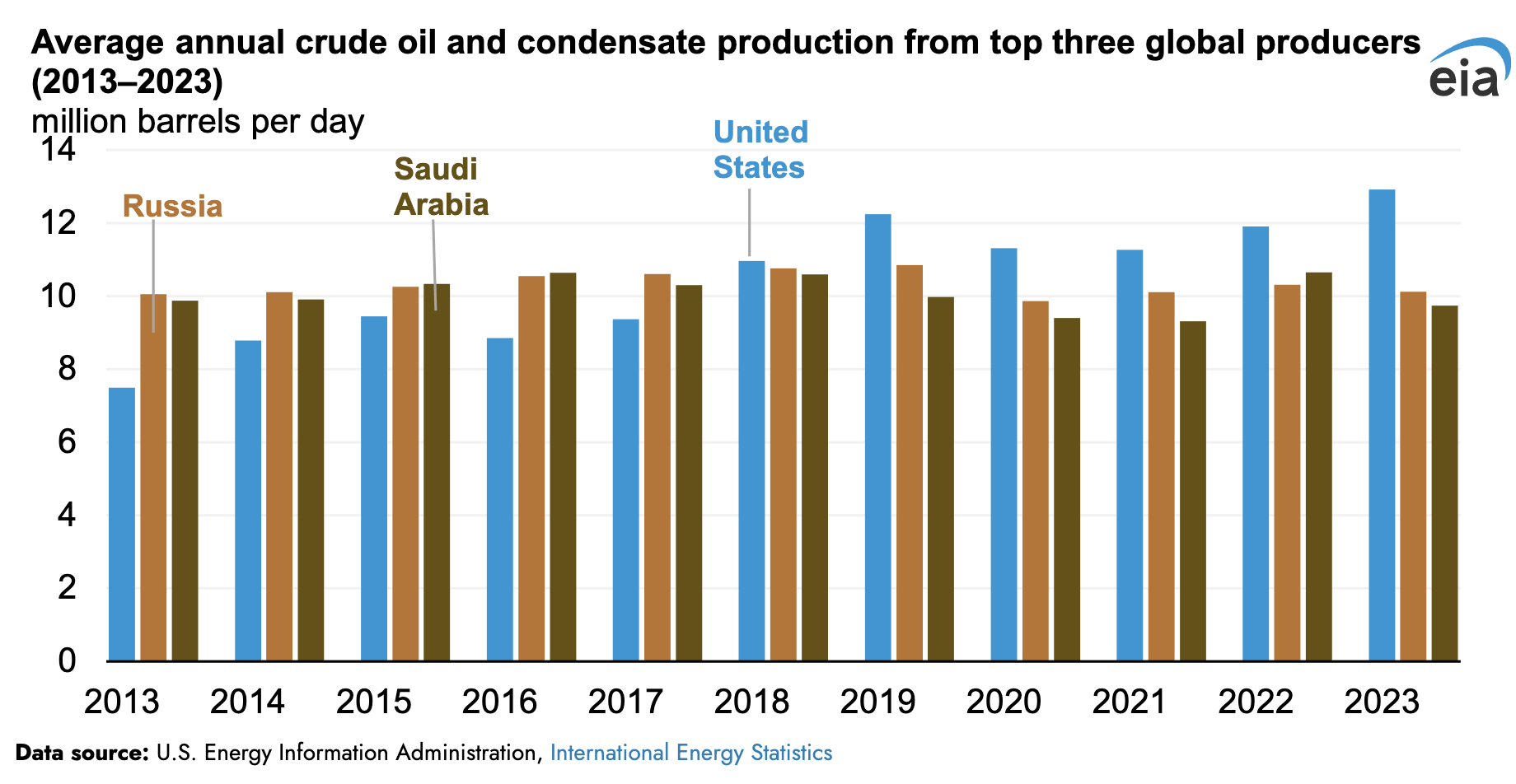

With government price controls, there was almost immediate scarcity for nearly a decade, but when prices were allowed to freely operate, abundance soon overflowed. That shows how governments tend to create scarcity while entrepreneurs (such as Hamm) produce abundance. In the United States, property owners have subsurface property rights. In most other countries, the government owns all the underground oil. These private property rights, a free market and lots of entrepreneurs and innovators have made the United States the most productive energy producer on the planet. The country has led the world in crude oil production since 2018:

Can you guess where gasoline is the most affordable on the planet? Please read “Where Gasoline is Most Affordable.”

Entrepreneurs create abundance; bureaucrats almost always create scarcity. Choose wisely.

Find more of Gale’s work at his Substack, Gale Winds.